Dear Dave,

My wife and I owe about $40,000 on our mortgage. My father-in-law, who is a very nice and generous man, said he wants to pay off the house for us, then let us pay him back over time. We’ve borrowed much smaller amounts of money from him in the past, and we were always able to repay it with no issues and no pressure. How do you feel about us taking him up on his offer?

Seth

Dear Seth,

I understand you and your wife have been fortunate in these kinds of situations over the years. And I know your father-in-law would probably be a lot easier to work with than a mortgage company when it comes to the size and frequency of payments. But I still think you’re playing with fire if you take him up on the offer.

I assume your father-in-law is doing pretty well financially, since he can afford to make this offer. But the downside is just too risky. If I were him, I might offer to pay off the mortgage as a gift to my daughter and son-in-law. But a loan? No way. There are no strings attached to a gift that comes from the heart.

Don’t get me wrong, Seth. I’m not bad-mouthing your father-in-law. What he’s making is a very generous offer, and it’s an incredibly nice thing to do. But in my mind, a very important consideration is being left out of the equation, and it’s a spiritual issue. The borrower is always slave to the lender. Always. And sadly enough, nowhere is that more true than within a family.

Accepting this offer could bring instant discomfort into the relationship for you and your wife. This money situation is likely to hang over things like a dark cloud. Thanksgiving, Christmas and other special occasions will feel different—and kind of weird—when you’re suddenly celebrating with your mortgage lender instead of just good, old dad.

Even if you come from a reasonable, stable family, and it sounds to me like your in-laws are very good-hearted folks, this debt will always be in the back of your mind. But if you’re involved with a dysfunctional or controlling family, that tension is going to be right there—constantly.

I’d thank your father-in-law for his generosity and for the offer. But in my mind, it’s just not worth the risk.

— Dave

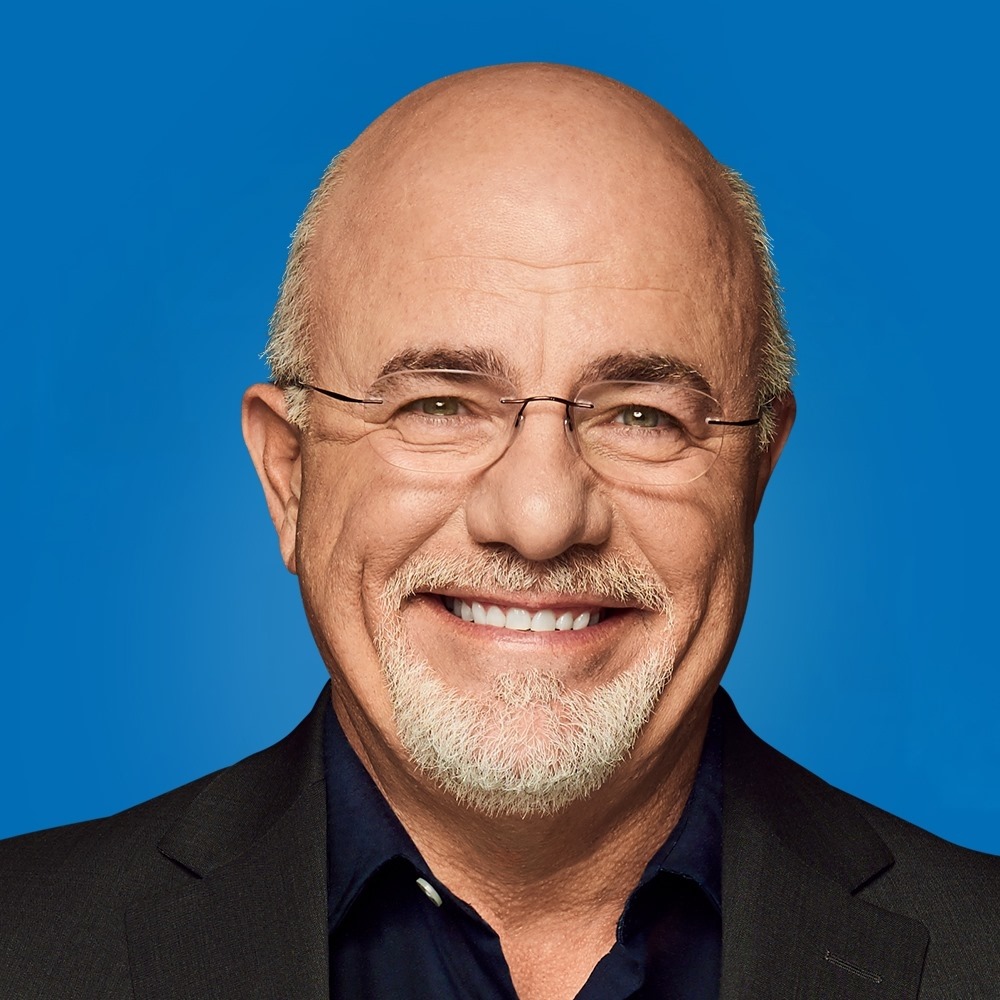

* Dave Ramsey is an eight-time No. 1 national best-selling author, personal finance expert and host of The Ramsey Show, heard by more than 20 million listeners each week. He has appeared on Good Morning America, CBS Mornings, Today Show, Fox News, CNN, Fox Business, and many more. Since 1992, Dave has helped people regain control of their money, build wealth and enhance their lives. He also serves as CEO for the company, Ramsey Solutions.