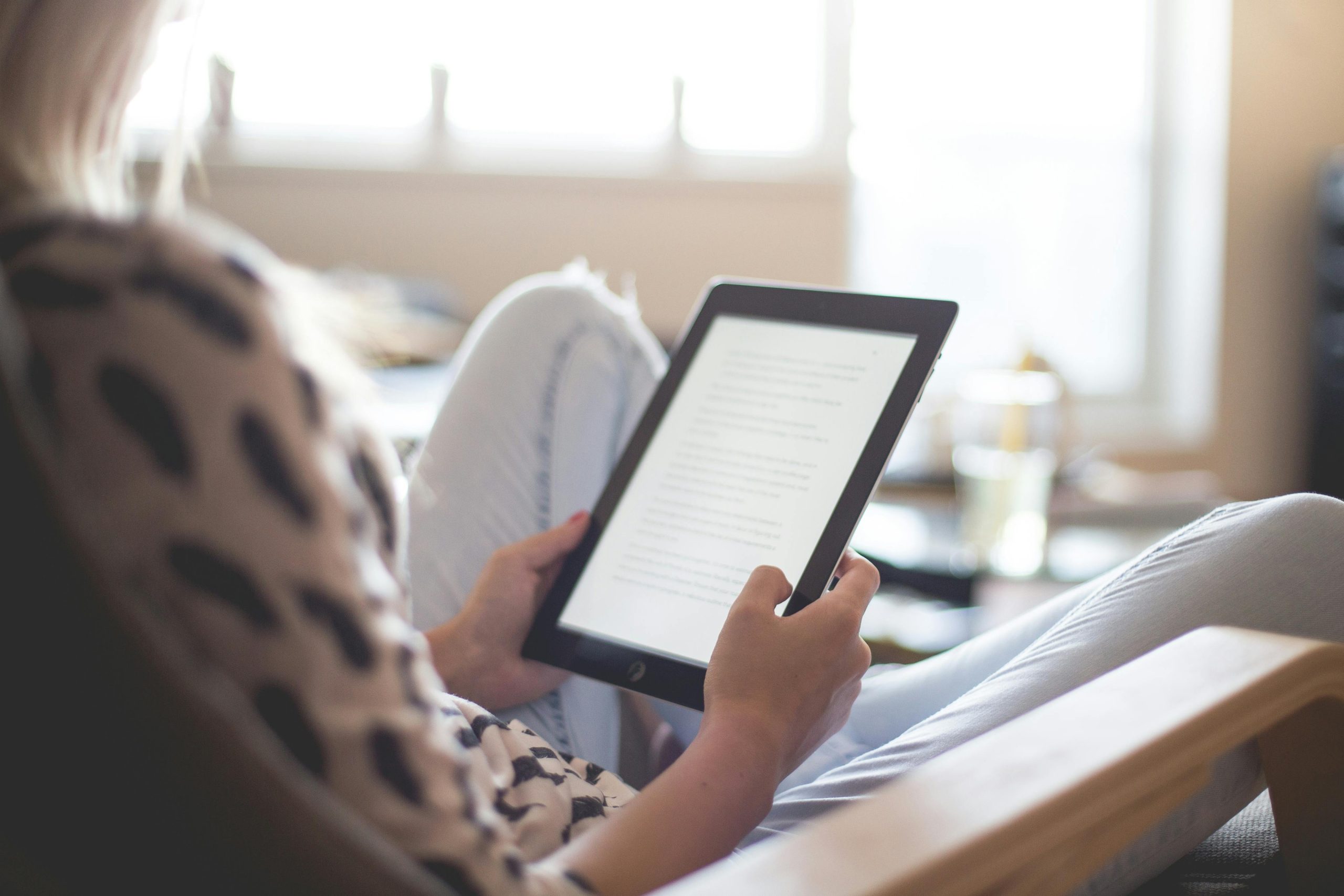

With an endless amount of financial advice books published each year, who should you listen to? Some financial experts have better insights than others. We’ve done Here are 6 money saving books that are actually worth reading.

1. The Psychology of Money, by Morgan Housel

In The Psychology of Money, Morgan Housel writes, “Doing well with money isn’t about what you know. It’s about how you behave. And behavior is hard to teach, even to really smart people.” Through sharing 19 short stories, Housel presents different ways people think about money and teaches you how to make sense of it all to improve your finances.

2. I Will Teach You to Be Rich, by Ramit Sethi

This is more than a money saving book. I Will Teach You to Be Rich is a practical 6-week program designed to help you develop the skills and mindset necessary to manage your money effectively. Ramit Sethi has sold more than 1 million copies of his book which centers around the concept that money should be simple. One reviewer on Amazon wrote, “Morgan Housel’s The Psychology of Money is not your typical finance book. It’s an insightful and profound exploration of how human behavior, rather than cold hard numbers, often determines financial success—or failure. If you’re looking for a book that teaches you how to manage wealth, understand greed, and find happiness, this is a timeless treasure trove of wisdom that transcends spreadsheets and stock markets.”

3. Rich Dad, Poor Dad, by Robert Kiyosaki

After more than two decades, Rich Dad, Poor Dad still ranks as the number one personal finance book. The book debunks the myth that you have to have a high income to be rich and helps you to make your money work for you. One reviewer writes, “Rich Dad Poor Dad by Robert Kiyosaki is an extraordinary book that has truly changed my perspective on money, wealth, and financial literacy. This insightful and empowering read presents invaluable lessons that the rich teach their children about money, contrasting it with the mindset and beliefs commonly held by the poor and middle class.”

4. Broke Millennial, by Erin Lowery

Broke Millennial helps millennials stop living paycheck to paycheck. Erin Lowery uses simple advice and humorous stories to help you become a money master. Most readers find that the book provides practical advice on budgeting, savings, and investment options.

5. The Latte Factor, by David Bach

If you’re looking for more of a novel, The Latte Factor may be for you. John David Mann introduces us to Zoey, a twenty-something living in New York City who is struggling to make ends meet, even though she has her dream job. Zoey soon learns the secrets to financial freedom through Henry, a barista at her favorite coffee shop. One review stated, “Forget sacrificing your beloved brew – the “Latte Factor” is a metaphor for the small, daily expenses that accumulate into a significant drain on your net worth over time. In plain English, Bach explains how redirecting these seemingly small amounts into savings and investments can lead to considerable wealth accumulation. No matter your age or stage in life, this book offers valuable insights that prove sometimes life-changing lessons come in small, easy-to-digest packages.”

6. Financial Feminist, by Tori Dunlap

In Financial Feminist, Tori Dunlap helps females who usually don’t get a holistic financial education, achieve financial freedom. Her money saving book focuses not on shame, judgment, and deprivation, but instead on money as providing choice and the freedom to live the way you want.

What are your favorite money saving books? Let us know what books have transformed your finances.

Read More

Master the Art of Cheap Travel: Hacks for Exploring on a Shoestring Budget!

7 Great Retirement Planning Books For Couples

No Comments yet!