Hi All,

Just posting a quick update as to what I’ve been up to financially. Briefly, it’s been bonds and fractional ownership of real estate.

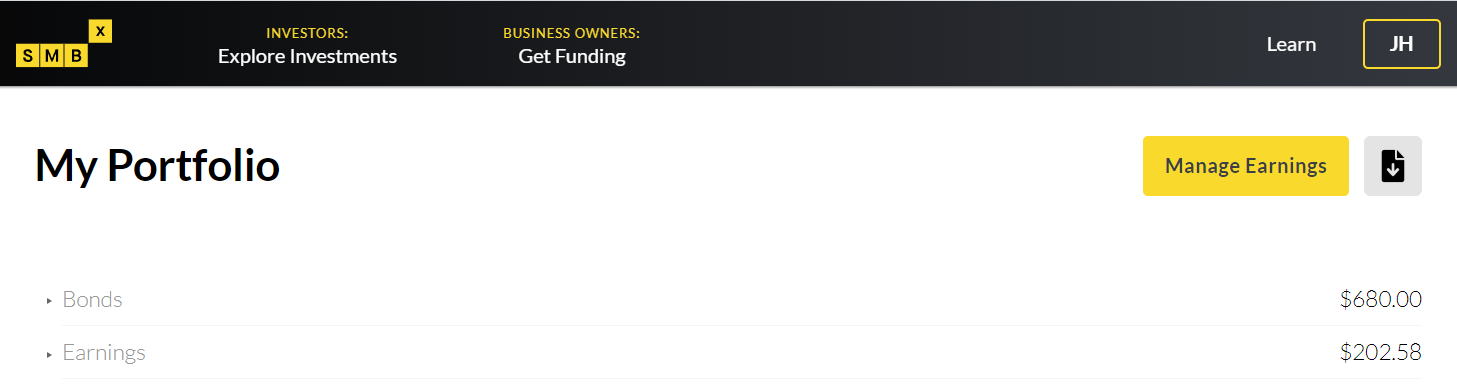

For bonds, I’ve been increasing my position in SMBX, which is a nifty little bond marketplace. We’ve covered it extensively on the site here, and here. I’ve been lending on the site for a couple of years and the results have been good, no defaults and the payments are generally made on time.

Here is my portfolio:

Also – because of how SMBX structures the bond paybacks, you get your principle and interest back on an accelerated schedule. This means you can rapidly reinvest in the platform. Plus, every time you get a payment, they send you an email. Its a nice little psychological win every time you get one of those.

Second I’ve been experimenting with some fractional ownership of real estate apps. This has mostly been experimental as my cash has been pretty constrained in the last few months.

Companies in this space that seem legit to me include:

- Ark7 => This outfit is new. They originated in the US Chinese community, and are doing some interesting things with their marketing and expansion strategy. I did an in depth review of them here, and recommend signing up if you are interested in targeted geographic investing, here.

- Fintor => This is also a new player in the space. For a while they had a super generous referral program. I had the impression it got picked up Facebook referral groups and passed around, so I don’t know how well they are growing their customer base. On the other hand, they have low share minimums and are good for investors who want real estate exposure and don’t have $20,000 for a downpayment. Here.

- Fundrise => This is a private REIT. Fundrise has low minimums and is generally well accepted by investors. I got in with them a few months back, and I think I’m down 5%. Worth checking out. Here.

I have accounts with all of these, and am satisfied with the results so far. I recommend you check them out if you just have a couple of hundred and want to get some exposure to real estate. Alternatively if you want a basic overview of how to get started in started in real estate, go here.

One question I’ve gotten is: how are these better than REITS? This is a good question, and I frankly have not thought it through.

On a final note, Nick Maggiulli over at Dollars and Data has an excellent observation the price of success. He notes that success almost always entails some extreme level of sacrifice, and in a lot of cases the level of sacrifice simply isn’t needed for happiness.

Read More

Here are 420,439 ways to make money on the web.

Yes, you can get ahead on $600 per month.

Don’t let your spouse yell at you, instead find constructive solutions to your martial trouble.

No Comments yet!