So it’s been a while since I posted a update about my Prosper.com investing.

Prosper is an interesting business, if you’re not into peer to peer lending, you should consider checking it out. Prosper is a company that basically offers a marketplace where lenders and borrowers can come together. I’ve been lending with the company since back in 2007.

There’s been a lot of changes with Prosper in the last thirteen years. The company moved away from it’s original model where individuals directly lent to borrowers. This was due in part to regulatory pressure and a high default rate on their loans. The company has since cleaned up their act and the percentage of delinquent loans has dropped from 30 to 4. Their model is still basically peer to peer, but the legal rules around the platform have matured a lot.

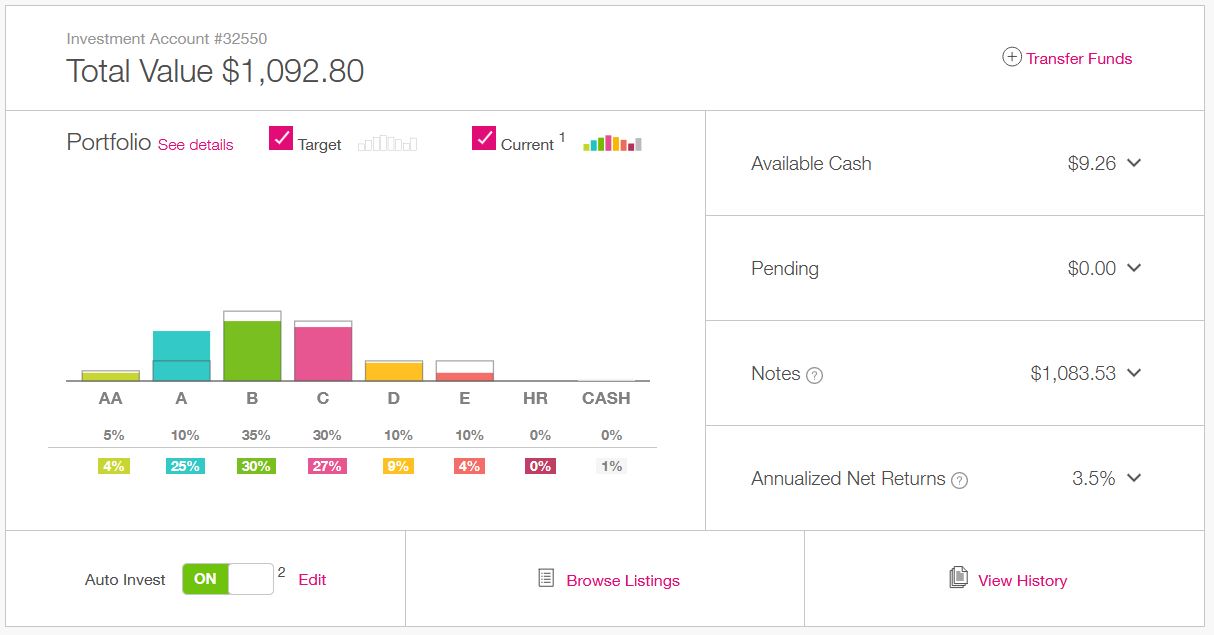

I’ve got $1,092 dollars in my Prosper account, it’s not a whole lot. But I’ve been consistently adding about $25 dollars per month.

Advantages and Disadvantages of Peer To Peer Lending:

So why bother with all this?

Prosper.com aside, peer to peer lending as an asset class has some interesting characteristics.

Here are some of the advantages:

1. Peer to peer lending reduces the volatility in your portfolio. That means when you add lending to your assets, the value of your overall portfolio will be less subject to wild price fluctuations. There isn’t a whole lot of evidence here, because peer to peer lending is still pretty new, but what exists is compelling (here).

2. In addition to lower volatility, peer to peer lending has returns that are generally high given the risk investors take. In investing terms, this is called having a healthy return to risk ratio.

There are some serious downsides:

1. Peer to peer lending, and Prosper in particular, is not a liquid asset class. This means that once you lend someone money, you’re stuck with the loan. You can’t sell it. It also means that you can’t trade your portfolio. So, for example, if economic conditions got bad, and you were holding a bunch of high quality loans, you couldn’t sell them for more than you paid. Your return is totally dependent on the borrower paying back the loan.

2. The Peer to peer lending industry may not survive. It is unclear if the two major players in the industry (Lending Club and Prosper) have longevity. For example, the value of Lending Club stock (LC) has fallen from $126 in 2014 to less than $6 dollars today. Prosper has also taken at least sixteen rounds of venture capital funding during and after 2013 (source). If these companies were generating profits, they’d be getting more valuable from an equity perspective, not less valuable.

What I’m Planning On Doing With Prosper

At this point I’m planning on investing a modest amount – probably $50 a month. A few years back, the account was worth more, but I had some credit card debt to pay off, so I was pulling cash out of prosper as it became available. I’ve gotten my spending under more control, so I should be able to start investing more money. I’ve also been getting about 3.5% returns. My thinking is to take a bit more risk. If I can get my returns up to 7% and invest $50 per month, in 5 years I should have around $5,060.92.

For more on the mechanics of wealth building, consider reading these:

Building Wealth on $600 Per Month

Ten Factors Affecting Your Wealth

Here are some of our historical Prosper articles:

Rethinking Our Prosper Strategy

No Comments yet!