This posting looks at millionaires and charitable giving. The general conception is that millionaires often give much of their wealth away to charity. In fact, in the blogosphere, this characteristic is viewed as one fundamental defining difference between millionaires and regular folks. However, its far from clear if in fact millionaires do give away more to charity.

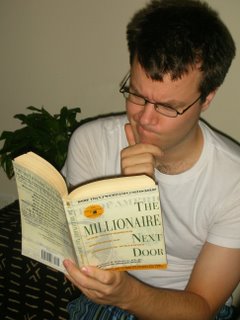

While some wealthy people undoubtedly do give away more, a lot of thinking on millionaires is driven by Stanley and Danko’s The Millionaire Next Door. The Stanley and Danko piece is one of the most popular books in personal finance ever, but there are serious problems with their data.

For example, Stanley and Danko surveyed a number of high net-worth households to find out how they became rich. However, only 20% of the people they surveyed answered their survey. This percentage is really low and begs the question of if the millionaires in their book are a good example of all American millionaires.

Not only that, other authors who have studied millionaires find they are defined by their stinginess (that is they don’t give anything much at all)! Specifically, Vance Oakley Packard writes on this in The Ultra Rich.

I find the stinginess argument more compelling. While giving to charity may have tax and social benefits, the mathematics of building wealth suggest that maximizing one’s holdings in business or investments is a more functional way of building and retaining wealth. Think about it, if you give away 10% of your income are you going to become wealthy more quickly or more slowly?

Food for thought.

I think Stanley and now Hogan with 10,000 millionaires surveyed both show millionaires are generous. In our case we’ve always given well over ten percent of our gross income even when we were broke to nonprofits and we are now multimillionaires. Many of my friends are far wealthier than us and they are amazingly generous. Sure, on paper I would have millions more if I wasn’t generous. So what? Life isn’t about being the richest guy in the cemetery. It’s about helping others. Wealthy people, generally more focused and more intentional people than average, understand that.

Steve – well its one perspective.

Obviously giving to charity has psychic benefits, as well as tax advantages…I just think the amount of charitable giving is probably overstated and I don’t Stanley and Danko’s data is representative.