Hi All,

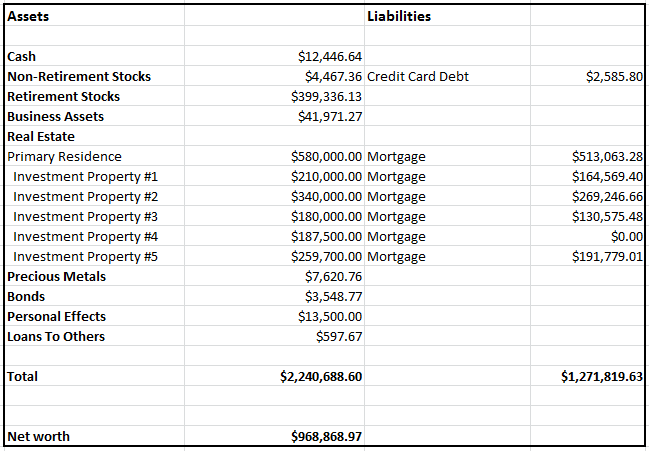

This weekend we sat down and tallied up our net worth. The figures for July are below.

The good news is that things are up overall, largely from gains in our retirement accounts.

We seem to have found some magic growth number. Back in May we had seen an increase of 3.3% to $937k net worth, and when we did the math this time around, we were again up 3.3% to $968k. At that rate, a million is attainable by around October.

While single digit returns aren’t necessarily something to write home about, averaging a $10k increase per month feels pretty good. It also means that we are that much closer to the $Million$ mark. In retrospect, getting to the million dollar mark feels very attainable now. It was only five years ago when we inched our way to the $400k mark, and now a million is clearly within sight.

We are reminded that steady progress is what it takes to attain and maintain goals, and that progress is all about perception. At this point we are kicking around a couple of ideas to help keep things moving.

1. Refinancing the mortgages on our primary residence. We think we should be able to shave a three or four hundred off our monthly payments and hopefully get some cash out.

2. Purchasing additional websites. Some web based business are strongly cash flow positive because of the very low material costs involved in maintaining the business. We obviously own and partially operate this website, but would like to potentially get a few more.

3. Investing more in peer to peer lending. Our annualized return at prosper.com has run something like 7% over the past 3 years – its way better than bonds or cash. So, we’ve been considering adding a bit more capital there.

4. Continuing expense reduction. James is paying something like $150.00 per month in cell phone bills, which is LOTS more than the $50 Miel pays. We’re planning on transferring James over to Miel’s plan – it should save $1,200 over a 12 month period. Plus, it’s about time to hit Comcast up for a reduction as well!

So, folks if you have any great ideas that will help bust the $1,000,000 mark, please don’t hesitate to let us know!

Best,

Miel & James

Very impressive. But all those rental properties scare me, are they rife with headaches?

I cannot imagine having wonderful tenants all the time?

Congrats on almost making it to a million, that’s very impressive! I feel like my wife and I won’t ever get there, but it’s great to see that you’ve gone from $400k to almost a million in just 5 years. It’s hard to see how growth affects everything at first, but it’s great when it finally kicks in. Hopefully you have another great few months coming up and you can write about being a millionaire then!

Hey NW – nah, we made a decisions a while back to only purchase properties in good parts of DC, so we only rent to people with good credit.

Jake, If you keep pushing it, you’ll get there. Its a slow slog, but doable. I want to encourage you to keep saving and investing and eventually you will get to where you need to be.

WOW!!! I am sooooo jealous!!! We have one rental home, but I want more. You have my dream financial setup, lol. I feel like I am falling behind the rest of the DINKS and I’m only 30…

Crystal

I want to affirm that you can get to where we are. If you make the decision, work hard, save and and keep at it – you can get there too.

James

Is all the rental property in DC? I was thinking you maybe had some on the other side of the country? Even with good tenants, rentals (maintenance)

canwill be a headache. I found that finding the right handyman to help deal with issues makes it much more manageable.2million – yep. You are correct. Pretty much we have places in DC and in Oregon. The places in Oregon are run in partnership with my wife Miel’s family.

One of the issues of expanding a business is that people who are paid to work in your business naturally have limits on their motivation and amount of labor they are willing to perform. To some degree, getting family involved can help to mitigate this – there are bonds of kinship and affiliation which tend to align interests.