There are tons of personal finance blogs on the web. Not all of them are the same, but one way you can evaluate the quality of the information you get is by understanding the writer’s financial situation. This is because people’s financial considerations differ depending on how much money they have. For example, someone with no assets and $50,000 in credit card debt is going to have a very different perspective than someone with $4,000,000 in stocks and no debt.

You can see this in the perspective of some popular bloggers. For example, Sam over at FinancialSamurai has assets which generate over $85,000 per year – and his content reflects the thought process of someone with high net worth. Clearly understanding a financial blogger’s perspective makes a difference in evaluating their approach to money.

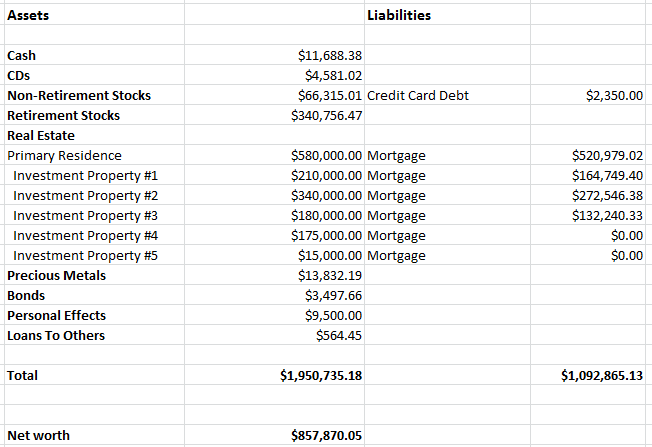

So, since my wife and I are blogging we should let you know about our financial situation. We have a net worth around of $850,000. The approximate figures are here (we are in the process of building the last vacation rental property, which we will share about shortly, and thus don’t have the final figures:

Eight hundred and fifty thousand is somewhat more than average. So, where did it all come from? Several sources:

1) Retirement and stocks: The bulk of the $340,000 in retirement funds we have is in ROTH IRA’s and 403b accounts. We contribute regularly towards our 403bs and Roth IRAs. After more than ten years of socking the cash away, the total has started to add up. The major issue with saving for retirement is that the assets can’t be efficiently converted from retirement to other asset types. If you try to take out the cash, you’ll incur withdrawal penalties and the proceeds will be subject to taxation. This is a problem as the highest return on equity is typically found in successful small businesses or direct investment in equities (15% to 30%). Not in the kinds of mutual funds that are typically found in retirement plans (about 7-10%).

2) Real estate: We have approximately 5 investment properties, three in Washington DC and two in Oregon. This has given us flexibility and a lot of potential upsides. First, the additional income helps to cope with large emergencies – for example the roof in our condo was damaged this winter, but because we had rental income we could cover the $8,700 in repair costs. Second, having a side real estate business helps to bring more people into your wealth building process. In our case, we are renting to people who can trade our real estate for monthly payments. So, we don’t have to pay for all of the bills ourselves, we leverage the work of people who can afford to rent from us – thus there more people helping drive our net worth growth. Third, if and when real estate asset prices recover, we should be well positioned to capitalize on any gains in housing. Forth, if needed one could borrow against the equity in the properties. Fifth, there are tax advantages, such as being able to deduct some of the costs and take depreciation on the rentals.

3) Inheritance: My wife Miel’s father passed away, so she inherited about $300,000 in cash and assets from his estate. While this is a tragedy for our family, the boost has really increased our overall net worth and also generates monthly revenue.

So, aside from trumpeting our balance sheet (which is fun), all this suggests several things for those interested in building wealth.

A) Contributing to retirement accounts works for building wealth. If you keep dumping money into your tax sheltered retirement accounts, its going to eventually compound and add up. Our advice, keeping contributing more and more, until you max out retirement contributions. For example, Miel started maxing out ($15,000 at the time) when she was only making around $40k annually, helping to beef up her retirement account and decrease our annual taxable income. People talk about the miracle of compound interest which often looks good on paper – but what looks good on paper doesn’t always work in real life. Well, in this case it does – funding your retirement can help juice your balance sheet. This also means paying attention to the fine print for employer contributions, Miel has been fortunate enough to have contributions in the range of 8-11% of her income, which adds up quickly.

B) Savings bonds and precious metals are less effective for building wealth. This is because of a couple of reasons. First, the interest rates on savings bonds are currently ridiculously low (.88%) – below the real rate of inflation. Second, precious metals don’t provide income. Unlike equities, which can pay quarterly or monthly dividends, you gain wealth from precious metals ownership by selling the asset, not by getting income. Because owning gold and silver directly doesn’t pay dividends – you can’t sit on the metal and get still the value from it. In any event, the growth from these assets has been way less than stocks, at least for us.

C) Taking risks can pay off. Our first joint stock purchase was a huge winner, Hansens (the maker of Monster Energy drinks), and walked away with more than a 50% gain on an investment of $60k in about four months. It was a huge risk, but with a massive return. Miel also made out big in her ROTH IRA with a pick of Netflix at the right time, tripling $3k worth of shares (bought at $44 and sold at $174, the share price is now at $82).

Readers, if you have any ideas for strategies to improve your net worth, we would love to hear it.

Please don’t hesitate to leave a comment (below).

Thanks,

James

Hey James!

I love all those rental properties! Real estate is my absolute favorite investment asset class to build long term wealth. Owners wake up 10 years from now one day and realize WOW, a lot of wealth has been created with other people’s money nonetheless. Tough going in the first several years, but almost automatic later on.

I’m going to be moving a good chunk of change from my pathetic money market accounts tomorrow (11/26/12) into a couple structured notes as a play on the S&P 500. I’m also investing more in P2P lending. Your cash balance to stock portfolio ratio is inspiring to take more risk.

Nice job on your net worth! I see 7 figures in your horizon very soon!

Best,

Sam

Thanks Sam, I’m frequently over at FS to see what’s going on. I appreciate your transparency and your perspective.

James

James – Unless I missed some posts, it’s been a while since you guys have posted a net worth update. It’s cool to see how you’ve progressed over the past few years and I hope these become consistent posts on DINKs like they were a couple years ago.

I also had no idea you had expanded to that many investment properties. I would love to have a few rental properties down the road.

Wow! It’s so awesome you have so many investment properties! Your net worth is so high! Keep on hustling ;0

Hey DC,

Thanks for the comments. I look forward to hearing about your rental property adventures as well!

James

Nice update James — can you post more of a breakdown on the rental acquisitions? Also just curious how did you make the property valuations? Are they Zillow estimates, your cost basis, or what?

Pingback:Putting Everything On Pfizer - DINKS Finance | DINKS Finance