Good Morning DINKS. The easiest way to achieve financial success, or success in anything for that matter, is to track our progress. The more often we check in on our goal progress and the more often we take on an active part in our goal setting, the more likely we are to succeed.

Throughout paying off my debt, accumulating savings, and completely changing my financial (and personal) life I noticed that the more often I focused on a goal the more interest I took in achieving it. Personally the more interested I am in my goals the more motivated I am to achieve it. Of course checking in regularly makes our goal seem a long way away since we only see a little bit of progress at a time, but a little bit of progress is better than no progress at all.

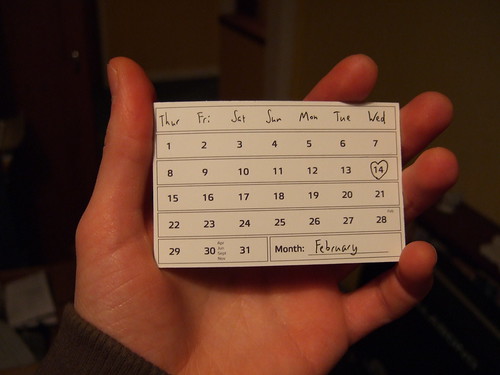

My advice for anyone who has set a financial or personal goal is to check in every 14 days. Get into a routine and make your check in date a day that you will always remember. Maybe your check in date is our pay day if you are paid on a biweekly basis. If you want to manage your goal on a more regular basis you could set a weekly check in date and check in on your finances every Saturday.

Whether we are paying bills, making mortgage payments, or saving money here are some reasons why more often is more beneficial. These are some helpful financial tips as to why we should do everything ever 14 days.

Pay Our Bills. It is a lot easier to pay a little bit more often than it is to try and find the money to make a lump sum payment once a month. If we have an emergency one month and we cannot afford to make a large lump sum payment our monthly bills will be late. It’s definitely easier to make smaller payments more often throughout the month. If we pay our bills only once a month we could forget the due date which is also not good.

Make Payments on our Credit Cards. Our monthly interest charges are calculated on our average daily credit cards balance throughout the month. Therefore if we make regular payments to our credit cards on a weekly or biweekly basis then our average daily balance will be less than it would be if we make a payment just once a month. If our average daily balance is less then our total monthly interest charges will also be less.

Invest and Save our Money. Saving is not investing, but regardless of our goals we should do each of them every 14 days. Saving is usually referred to as our cash stash and investing is for a longer time horizon. If we earn interest on a monthly basis it can be more profitable to regularly add money throughout the month as oppose to just one time. If we are purchasing stocks or mutual funds we can take advantage of an investment strategy called dollar cost averaging if we buy units regularly throughout the month.

Photo by Joe Lanman

We do very similar things, except we pay our credit cards whenever, as long as its before the end of the month so that we don’t carry a balance.

I like this concept because it’s nice and short term. I find with longer goals, I get lost in the time that it takes to reach them, but with checking in every 14 days that reduces the risk of goal fatigue.

Great advice. For other longer term goals, it’d better to break them down into smaller goals that you can check in every day!

I’m a huge goals oriented person as well. For me checking in regularly keeps me on track, but also reminds me of what I’m working towards. Seeing progress definitely brings me more motivation. One of the biggest ways for me to complete my goals, is the old fashioned pen and paper. Writing a to-do list or wish list is so empowering, and I have much higher success rate overall.

I love tracking short term goals, it makes it much easier to achieve and definitely (like Carrie) keeps me motivated. I tend to lose interest very quickly! I love the old school pad and pen system as well becuase no matter what happens with my laptop I can still keep up to date.

Sometimes it is easy to lose focus on our goals, so I think this is a good reminder. We need to keep coming back to why were are doing what we are doing. The main goal is to get out of debt.

Some people think you should review your goals every morning.

Some people think you should review your goals every morning. This is helpful as it motivates you to focus your energy and efforts during the day.

Pingback:Do you want to save money on your mortgage? | DINKS Finance